Democrats have an opportunity on Thursday to do something about inflation that would take less than one minute, would be immune to Republican obstruction, and would take effect almost instantly. But there’s no sign they’re going to.

On Thursday, Senate Democrats on the Agriculture, Nutrition and Forestry Committee will question a top regulator about the FTX crash – it's a fraught, complex issue for the committee, but members can also ask any questions they want, and a single question about Wall Street manipulation of commodity prices could change everything, a former regulator tells TYT.

Former Commodity Futures Trading Commission (CFTC) Director of Markets and Trading Michael Greenberger says that just raising the issue of how unregulated derivatives trades have distorted commodity prices could spook Wall Street into easing up on those trades. And, Greenberger says, that alone would bring prices down.

Specifically, the committee could ask its witness, the CFTC chair, about closing the regulatory loophole, known as the Footnote 563 Loophole, which unleashed a gusher of unregulated trading in commodity-based swaps. Greenberger told TYT he thinks they should. So did at least one member of Congress and another financial industry watchdog.

But while some House Democrats are aware of the issue and pushing for action, not a single Democratic member of the Senate’s Agriculture Committee responded to TYT’s emails asking whether they intend to use their opportunity to ask about it on Thursday.

The committee has already come under criticism for its oversight of the CFTC, especially when it comes to financial regulatory issues far from the original, core mission of overseeing the trading of agricultural futures.

When Pres. Joe Biden took office, the CFTC was down to just two members out of five. It wasn’t until Sept. 19, 2021, that the White House announced his nominees to fill the Democrat slots on the commission.

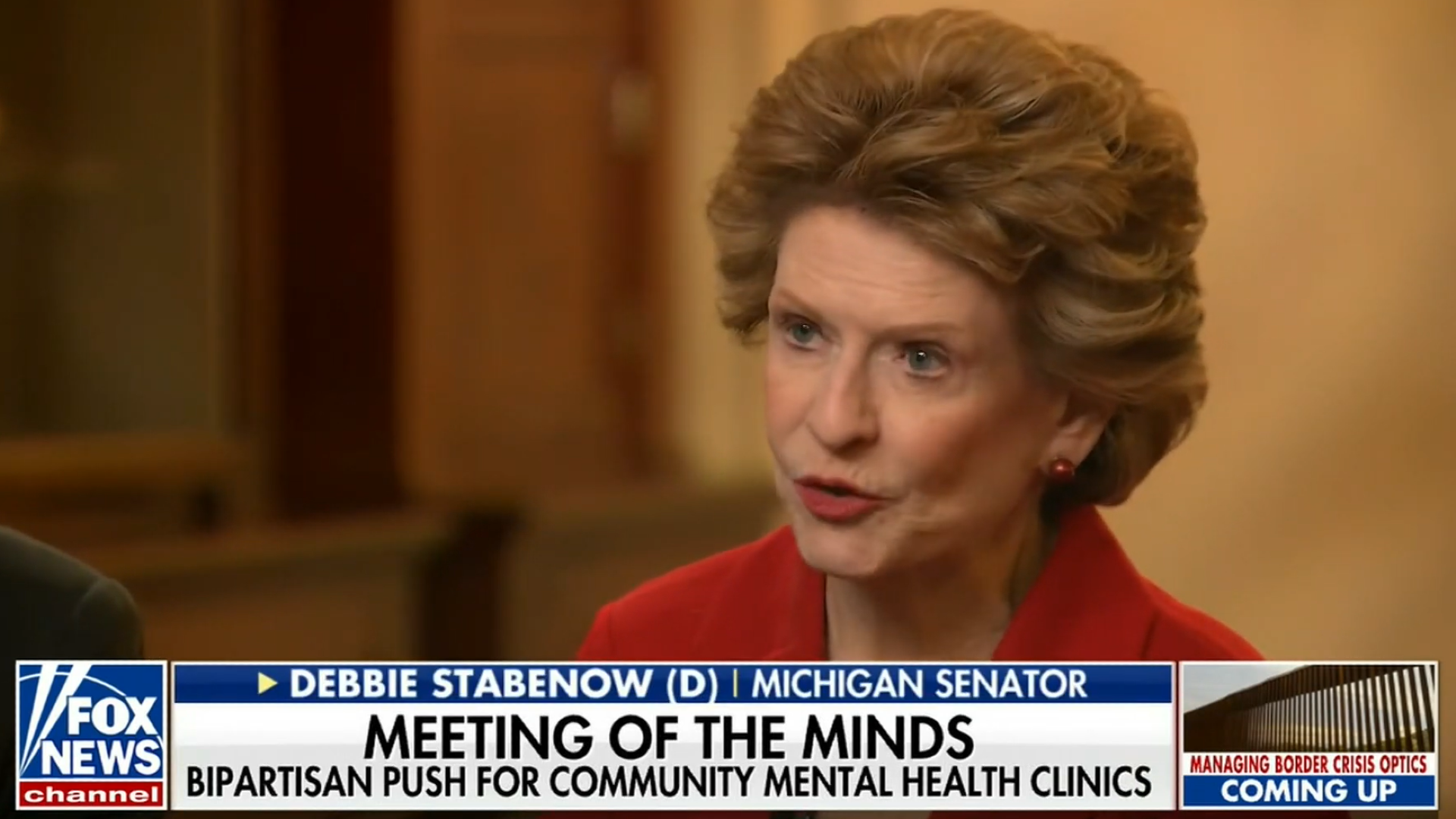

But under Chair Debbie Stabenow (D-MI), the agriculture committee didn’t give Biden’s nominees a hearing until almost five months later. They were confirmed by the full Senate later that month; by then, Biden had been in office for more than a year and gas prices were already rising.

As the Revolving Door Project’s Eleanor Eagan told TYT in May, “It took quite a while for Biden to nominate commissioners…The Senate moved a little bit faster in this case, but certainly not as quickly as one would have hoped.”

Public Citizen’s Energy Program Director Tyson Slocum told TYT around the same time that “[T]he Senate [was] not acting fast enough.”

Slocum attributed the lack of urgency to a scarcity of “top [administration] people that understand commodity markets.” And, as Greenberger put it, “there’s nobody on the Hill who’s really on top of this stuff.”

That may be changing at the CFTC, however long it took. At least one of the new commissioners, Christy Goldsmith Romero, has publicly suggested that the CFTC needs to do more to ensure commodity prices are being driven by fundamentals, rather than by Wall Street.

But this CFTC has yet to take significant steps in that direction.

Some House Democrats have been pushing for action, including Rep. Ro Khanna (D-CA), who told TYT in June that he wants the CFTC to take action. Also in June, Americans for Financial Reform Senior Policy Analyst Andrew Park said, "For all the finger pointing about the causes of inflation, both the commodities and banking regulators should be looking into how closing this critical loophole for commodity swaps could stomp out this unproductive speculation across several critical commodities, that in turn, have raised the prices billions of people pay for fuel and food across the world."

Dr. Steven Suppan, senior policy analyst for the Institute for Agriculture and Trade Policy (IATP), called TYT’s initial report on the loophole "a public service to connect current commodity price levels and volatility to the failed Trump cross-border swaps rule."

In 2020, the IATP urged the CFTC under then-Pres. Donald Trump not to cement the loophole into place. Dominated by Trump appointees, the CFTC did anyway, even though Suppan warned the CFTC it needed rules to prevent the rise of "a system that amplifies the price responses to ... shocks."

Since then, Khanna told TYT in June, "Lax regulation on swaps has been a windfall for banks and contributed to price spikes. I support reforms like the one proposed by the Obama administration in 2016 that would close this loophole."

CFTC member Rostin Behnam was part of that effort in 2016 and then led the opposition when Trump appointees later cemented the loophole into place. Now the CFTC’s chair, Behnam has yet to revive the crusade to close Footnote 563.

It’s Behnam who’s testifying Thursday. The hearing agenda is solely the FTX crash, but when asked if Senate committee members should take the opportunity to press Behnam about closing Loophole 563, Slocum said, “Heck yes.” On Monday, Khanna also told TYT the committee should ask Behnam about closing the Footnote 563 Loophole. (TYT's activist arm has mounted a petition drive calling on senators to raise the issue.)

If even a single senator pushes Behnam about Footnote 563, that alone could bring prices down.

That’s according to Greenberger, who first identified Footnote 563’s impact on commodity prices, as well as its potential to bring down world markets in a repeat of the 2008 mortgage crash.

Greenberger’s history includes a similar claim about gas prices in 2008, when he pinpointed the role of another loophole in letting Wall Street manipulate energy prices. Under Pres. Barack Obama, the Enron Loophole was closed, and prices came down.

True to Greenberger’s prediction back in May, the price of gas this year has defied fundamentals. Prices fell for 99 days straight starting this summer – the height of travel season – for no discernible reason. As Greenberger specifically predicted, production cuts by oil-producing states last month were followed not by price spikes but by similar softening.

Republicans have stuck to supply-and-demand explanations, insisting that if the U.S. produces more oil, it will somehow impact the massive world market. But Biden’s releases from the Strategic Petroleum Reserve have done little to the move the needle.

Democrats, meanwhile, blame U.S. companies for price gouging. And while it’s true the gas companies are racking up record profits, in a functional market at least some of them would be undercutting the others’ prices – but that’s only possible if they’re the ones setting the prices.

Instead, Greenberger says, it’s four Wall Street firms heavily invested in commodity-based swaps trading: Goldman Sachs, Citigroup, JPMorgan Stanley, and Bank of America. Slocum says private-equity firms are also driving oil futures.

If the CFTC fails to close the loophole, the Senate Agriculture Committee can hold hearings on why. So far, however, the committee appears unaware of the problem itself.

Jonathan Larsen is TYT's managing editor. You can find him on Twitter @JTLarsen_._riginal